Do you want to know how to use technical analysis in trading? If so, then learning about topping formation patterns is vital. Whether you’re a novice investor or have been around the market for many years, correctly understanding these particular chart patterns can help you identify entry and exit points more accurately, improving your return on investment.

In this article, we will explore topping formation patterns, the different types, and some tips on detecting them early enough to increase your potential profitability as an investor. So read on if you’d like to gain insight into one of the most potent tools in technical analysis.

What is a topping formation, and why should you pay attention to it in technical analysis

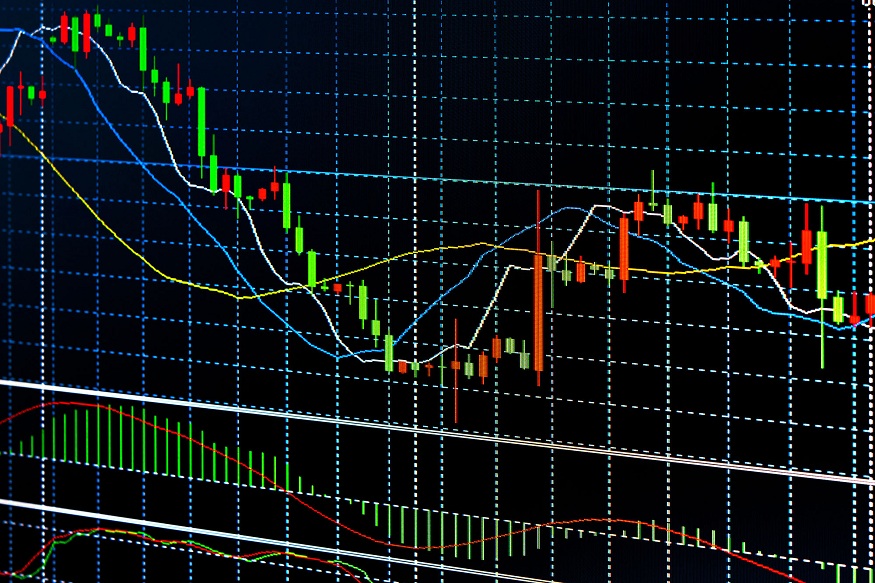

In forex trading, technical analysis can be a crucial tool to make informed decisions about the market. One aspect of technical analysis is identifying patterns, such as topping formations. A topping formation occurs when a market trend reaches a peak and begins to decline, indicating a possible change in direction. It can be a valuable signal for traders to sell or potentially go short.

Paying attention to topping formations can help forex traders anticipate market movements and position themselves accordingly. By staying aware of these patterns and incorporating them into their analysis, traders can increase their chances of success in the fast-paced world of forex trading. Additionally, traders can use topping formations to identify market entry and exit points.

Identifying the three types of topping formations – double top, head and shoulders top and triple top

Topping formations can generally be categorised into three distinct types. The first is a double top, which occurs when the market reaches a peak and begins to decline, only to rebound again before dropping further. Traders often use this pattern to identify potential sell signals for their positions.

The second is the head and shoulders top, which occurs when a market trend begins to peak and then declines three times, with the middle peak higher than the other two. This pattern is usually seen as a strong signal that the market will soon reverse its direction.

Finally, there is the triple top, which is similar to a double top but occurs when the market peaks three times before declining. This pattern, too, can be used by traders to identify a possible reversal in the market and act accordingly.

How to interpret each type of pattern and understand what they signify

It is crucial to be able to interpret each of these patterns to make informed decisions about the market. A double top indicates that the uptrend has reached its peak and may begin to decline soon, while a head and shoulders top signals that the trend has peaked three times before beginning to decline. On the other hand, a triple top suggests that the trend may have reached its peak and may be about to reverse.

In addition to recognising these patterns, it is also essential to understand what they signify. For example, a double top could indicate the beginning of a bearish trend, while a head and shoulders pattern might suggest that the market will soon turn bullish. By understanding how these patterns work, traders can make more informed decisions about their trades.

Strategies for trading around the different types of formations

Once traders have identified a topping formation, they can use strategies to trade around it. One strategy is to look for entry points when the market is trending in the direction of the pattern. For example, if a double top is forming, traders could enter at the second peak and wait for the market to reverse before exiting their position.

Another strategy is to use stop-loss orders to protect against potential losses. By placing a stop order at the point where the market reversed, traders can limit their exposure and minimise any losses if the market moves in an unexpected direction.

Finally, traders must consider overall market sentiment when trading around topping formations. Being aware of external events and news that could affect the market can help traders make better decisions and increase the chances of their trades being lucrative.

Tips for avoiding false signals when identifying topping patterns

Finally, there are some tips traders can use to avoid false signals when identifying topping patterns. The first is looking for multiple market peaks rather than relying on just one. It will help prevent traders from mistaking a short-term fluctuation as a signal to enter or exit a position.

Another tip is to study the market’s overall trend before entering a trade. By understanding the market’s general direction, traders can better anticipate any potential reversals and increase their chances of success. Finally, traders must use multiple indicators when making trading decisions. Combining various technical analysis tools such as moving averages and Bollinger Bands will help traders get a more accurate picture of the market and make more informed decisions.